A Project based organization in streamlining their

Financial Systems

and Processes

The cluster approach

The Finance cluster programme was structured in such a way that progress was reviewed by the anchor every 30 days. Tools & Techniques were explained in a classroom session, along with other cluster members. The team then had 15 days to implement the learnings and embed systems and processes. This was reviewed by the anchor during a mentoring session and inputs were given. The team took corrective action and presented progress to the anchor after the next 30 days. This cycle was repeated for a period of 8 months. The last 2 sessions was in a board room format to enable the CEO to do a finance review. This entire process was an eye opener for the CEO as he was able to understand the key financial indicators to his business. Decision making was thus, more holistic. Timely financial visibility into the health and strength of the business was another key takeaway.

A. Background

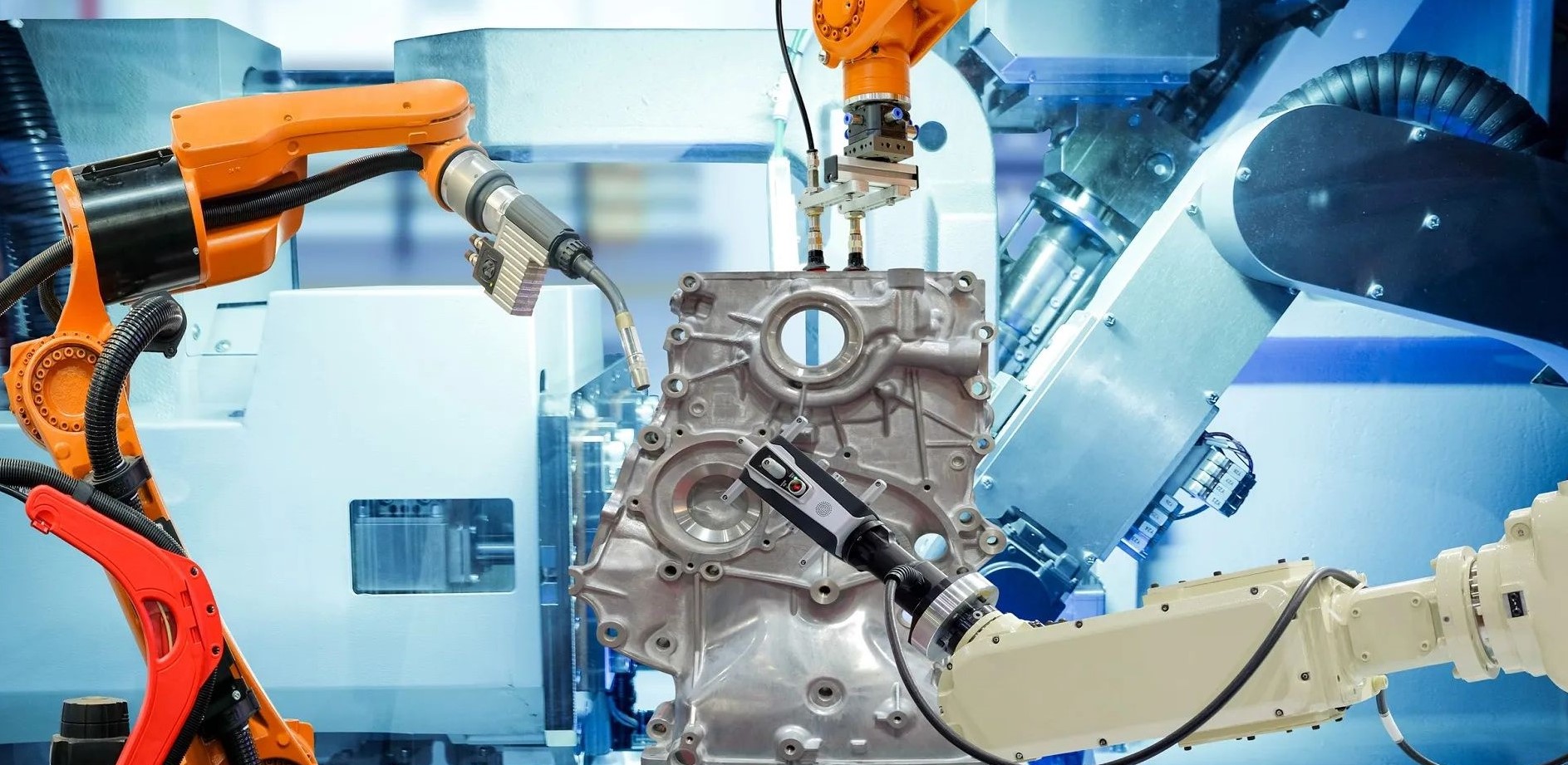

A Project based organization incorporated in the year 2014, approached the institute with a need to address their pain areas related to finances which include working capital management and creating a competitive pricing mechanism. The company is a less asset intensive one and its core strength is development of control solutions to manufacturing industries. The organization provides turnkey solutions in design, new build, refurbishments and retrofits in processes. It is involved in study, architecture & design, manufacturing, implementation and post project follow up of various assignments across multiple industries and processes. The key customer profile includes Grasim Industries Limited, TVS Motors Co Ltd, Automotive Axles Limited, L&T Construction And Equipment Ltd, Mico Bosch Limited, Toyota Group, Makino India Pvt Ltd, Saint Gobain, Jindal Aluminium, ISRO, Siemens, Kriloskar.

B. Business challenges faced

C. Approaches to the challenges

Capital deployment and management

of funds for projects:

The main pain area for the organization was related to its capital deployment for funding its future projects. The customers used to release PO with payment terms as 15% in advance, 70% at the time of receiving the equipment and balance 15% on credit.

The time line for the project till 85% completion is about 18 months. The project turnaround time was always above the planned which was affecting the cash flow. Thus, managing the funds for project in this scenario was a problem.

Moreover, the pricing mechanism used was

adhoc and not all the factors were

accounted in while pricing. For instance,

the CEO along with a senior person were

closing the order and were completely involved

in the design and conceptualization phase,

which requires major efforts. This was not

accounted in the pricing of the solution. Also

there was no MIS system and the team had

minimum visibility and clarity about their

finances.

After understanding the challenges, the anchor helped the team to create a budget for the organization for the complete financial year, considering all current and future/prospect projects

The organization realized during the course of cluster that a project based budgeting is the best way out for them. The organization also prepared a cash flow statement with actual cash inflow and outflow to manage working capital.

This was reviewed every month by the anchor and team. The team also did a budget v/s actual analysis to understand the budgeting exercise and how can they improve it next time.

The anchor also gave the team inputs for leveraging on insurance and tax benefits which helped them to cover their risks.

D. Tools and Techniques applied

- Project management software was suggested to have clarity and accountability of work between team members. This benefitted the organization to the maximum extent by way of accounting of time and efforts spent on each project and also by way of managing the projects that are being implemented across the globe.

- The budget prepared was monitored closely and appropriate action points for variations were jotted down.

- Chart of accounts was clearly defined.

- All financial ratios were studied to understand the financial health of the organization and appropriate actions were taken to stabilize the business.

- An MIS pack that facilitated a regular monthly review of profitability, working capital status, inventory, Balance sheet and cash flow was established.

- Asset numbering was suggested for proper accounting of assets.

- Costing techniques were introduced and were integrated into budgeting and pricing strategies.

E. Benefits observed

- Establishing project management software gave the entire team visibility of status for each project.

- Project wise budget was created. This helped in establishing control measures in a more focused manner.

- Ratio analysis helped the organization to understand which ratios to follow, focus and then take corrective actions.

- Efforts on risk analysis help the organization to categorize its risks and build strategies to mitigate those risks.

- A financial MIS pack for review has facilitated strategic decision making. This has also helped raise red flags in advance so that the organization was able to manage the challenge appropriately.

- Financial systems and processes in the organization were streamlined ensuring greater transparency and clarity.

- Techniques in reading, understanding and analysis of financial statements helped the organization to prepare their financial statements so that they can be leveraged better.

F. Conclusions and Recommendations for future growth and sustainability

- Continue the project management software across the organisation which will help the organisation to manage their projects better, save costs and mitigate various project related risks.

- Follow project based costing and budgeting techniques to reduce and control costs and optimise profits in a competitive scenario.

- Evaluate and continuously improve MIS processes and templates on a regular basis, preferably once in six months, to make the system more practical and address the present requirements of the organisation.

- Continue involving the team members in all the relevant processes and techniques learned and implemented during the cluster program so that it becomes an organisational culture.

- Introduce various audits and reviews to study multiple things from time to time.

- Strengthen internal controls whenever any issue crops up within the organisation. Develop the practice of analysis the problems to identify the source of the control issue and plug the lack of control by building systems.

- Improvise the contracting systems considering increase of international presence of the organisation.